As a Tax accountant, I often hear people say;

“Taxes in Japan are so expensive!”

“Because the tax rate is progressive, the more I earn, the higher the tax rate is.”

“It makes me want to work less hard.”

As you may know, the income tax rate in Japan is high compared to other countries.

45% at maximum.

But every time I mention the tax rate in the past, they will always be stunned.

Let’s see how the income tax rate in Japan has changed over the years.

See this on YouTube↓

目次-Contents-

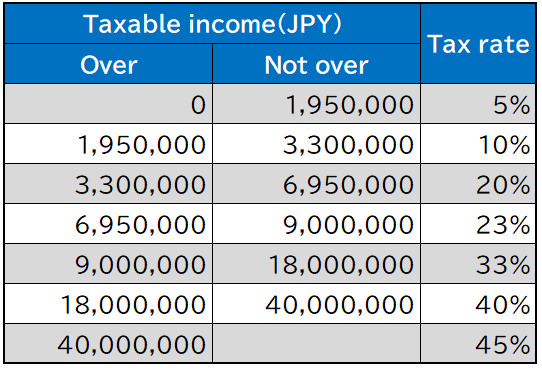

Current Tax Bracket

Before we get into how the Income-tax rate has changed, let me show you the current tax bracket.

Income tax is imposed not on your total salary but on “Taxable income”.

Taxable income is calculated salary/sales minus cost spent on your business.

If you earn 1,000,000 yen, your tax rate is 5% and the tax amount is 50,000 yen.

What if you earn 2,000,000 yen?

You pay 200,000 yen tax because your tax bracket shows 10%?

No. The 10% tax rate applies to the taxable amount which exceeds 1,950,000 yen.

In this case, the tax amount is 102,500 yen (1+2 as below)

- 1,950,000 ×5% = 97,500 yen

- (2,000,000 minus 1,950,000) ×10% = 5,000 yen

Anyway, the highest tax rate is 45% now.

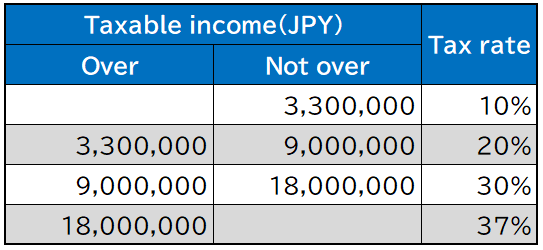

The lowest tax rate period

The period when the Income-tax rate is the LOWEST is from 1999 to 2006.

The numbers of the Bracket was less as below.

The highest tax rate from 1999 to 2006 is 37%.

The highest tax rate period

The period when the Income-tax rate is the HIGHEST is from 1974 to 1983.

The numbers of the Bracket was so many as below.

The Income-tax rate then is as high as 75%!

If I were then, I wouldn’t want to make a lot of money.

I imagine there were lots of tax evasion cases then.

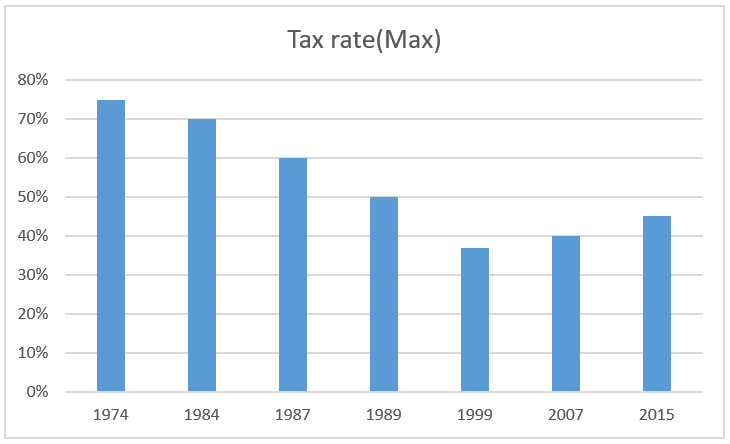

The transition of the maximum tax rate

The maximum tax rate had kept lowering until 1999.

But since then, it continues to rise.

And I’m confident that the tax rate will be going up taking into account that the government debt is increasing.

To conclude;

We always argue that the tax is so high these days.

But seeing the tax rate in the past, the current 45% maximum tax rate seems not bad.

Having any concerns like these with your accountant?

Your tax accountant…

- changes every year

- suggests no tax-saving measures

- doesn’t give you financial statements in a timely manner

- doesn’t explain the contents of the statements

- is reluctant to use the cloud software

- rarely shows up to your office

- is always late to answer your questions

- is elderly and you’re worried about the near future

Lack of communication with tax accountants can cause incorrect accounting processing due to the mess of the contents of the bookkeeping.

As a result, it increases the risk of additional taxation of up to 40% through a tax audit which is conducted once every 3 to 5 years.

To prevent paying additional taxes, it is important to share accounting processing and the business environment with tax accountants on a daily basis and to take measures to address additional taxation risks at an early stage.

We, Masa Tax Consulting, not only consult on accounting contents but also provide tax audit preparing measures and proposals for tax-saving measures that are optimal for customers as the most casual/friendly tax accountant in Japan.

We now offer a free initial consultation and a first-month-free policy.

We do not force you to make any contract, so please feel free to contact us.

~The representative tax accountant will always respond responsibly.~